YOUR WEALTH JOURNEY

Over your life, you will come across many surprises, however sound financial advice will always be handy. Your Wealth Journey is a discovery of how financial planning and financial advice works with you, throughout your life, to help you turn dreams into reality. Take just a few minutes and experience your journey and find out how financial advice can benefit you, no matter what stage of life you are at. At the end of the story you will have the option to contact us to help you through your journey.

RETIREMENT

Life for everyone will come to an end one day, every day is a step forward and you can never go back. Every day that you fail to act has a cost for the rest of your life - there is an economic cost to inaction. Life rolls on and you can’t stop it. Retirement is a major watershed. Suddenly income stops and forever you are reliant on your savings or the government to live. So we need to plan far in advance for that.

LIFE EXPENSES

As life goes on a few events may take place, you get married to your partner and buy a house, you have a few kids and your living costs gradually increase. It is obvious that higher costs occur when kids are teenagers when they consume like adults, education costs are highest and you want to participate in holidays and activities with them before they turn into adults.

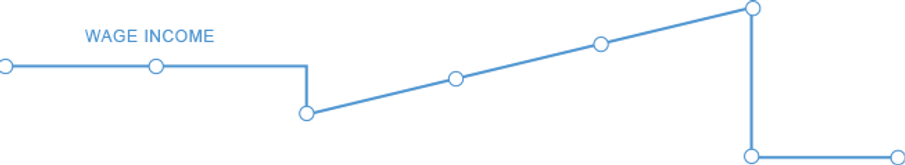

INCOME

Your income follows a different pattern. When you have kids you go from 2 incomes to 1, but then grows again as you gain experience in the workforce, but then at retirement it just stops (known as the fiscal cliff)….but your living costs will tend to continue.

YOUR PROTECTION

Your overall protective activities are your wills, powers of attorney, trusts etc. Insurance is your other main protective activity. Insurance is greatest when you start a family and reduces over time as your kids get closer to independence, your mortgage gets paid down and your assets go up. It ceases at retirement when you are finally fully financially self-sufficient.

LIFE CHOICES

But aside from your financial well being, you need to consider your lifestyle. There are always things you want to do along your journey that feed you quality of life. These things cost money, but your investments make you money. If you do all of one you get bored, if you do all of the other you go broke!

JTAX WEALTH SOLUTIONS ADVICE

So draw a line in the sand today…how long do you have left to work…how long will you be retired for…what protection do you have in place….what financial resources have you got….what do you want when you retire? Then review regularly and tick off your goals along the way with us!